Venturing into the public markets constitutes a momentous step for any growing enterprise. For Andy Altahawi, an aspiring entrepreneur with a groundbreaking idea, understanding the intricacies of the IPO landscape is paramount to a triumphant launch. This guide sheds light on key considerations and approaches to steer through the IPO journey.

- , Begin by meticulously assessing your firm's readiness for an IPO. Think about factors such as financial performance, market share, and operational infrastructure.

- Connect with a team of experienced consultants who specialize in IPOs. Their expertise will be invaluable throughout the lengthy process.

- Craft a compelling business plan that presents your company's trajectory potential and value proposition.

Finally the IPO journey is an arduous process. Completion requires meticulous planning, unwavering commitment, and a deep understanding of the market dynamics at play.

Direct Listings vs. Traditional IPOS: The Best Path for Andy Altahawi's Venture?

Andy Altahawi's startup is reaching a significant juncture, with the potential for an public listing. Two distinct paths stand before him: the conventional listing and the emerging alternative of a alternative exchange. Each offers unique perks, and understanding their distinctions is crucial for Altahawi's success. A traditional IPO involves engaging underwriters to handle the logistics, resulting in a public listing on a financial platform. Conversely, a direct listing bypasses this intermediary entirely, allowing entities to offer shares to the public via trading platforms. This novel strategy can be less expensive and retain autonomy, but it may also involve hurdles in terms of public awareness.

Altahawi must carefully weigh these elements to determine the most suitable strategy for his venture. Factors influencing the decision include his company's unique circumstances, market conditions, and investor appetite.

Unlocking Capital Through Direct Exchange Listings: Opportunities for Andy Altahawi

For aspiring entrepreneurs like Andy Altahawi, navigating the complex world of funding can be a daunting challenge. Conventional avenues like venture capital often come with stringent requirements and diluted ownership stakes. However, a compelling alternative is emerging: direct exchange listings. This strategic approach allows companies to bypass intermediaries and immediately offer their securities to the public on established stock exchanges.

The benefits of direct exchange listings are substantial. Andy Altahawi could leverage this mechanism to secure much-needed capital, driving the growth of his ventures. Furthermore, direct listings offer greater transparency and accessibility for investors, which can accelerate market confidence and ultimately lead to a flourishing ecosystem.

- Ultimately, direct exchange listings present a unique opportunity for Andy Altahawi to unlock capital, bolster his entrepreneurial endeavors, and contribute in the dynamic world of public markets.

Ahmad Altahawi and the Rise of Direct Equity Access

Direct equity access is quickly transforming the financial landscape, offering unprecedented possibilities for individuals to invest in private companies. At the forefront of this transformation stands Andy Altahawi, a visionary figure who has dedicated himself to making equity access greater obtainable for all.

Altahawi's voyage began with a strong belief that people should have the ability to participate in the growth of successful companies. Such belief fueled his determination to create a platform that would break down the barriers to equity access and enable individuals to become active investors.

Altahawi's contribution has been profound. His initiative, [Company Name], has emerged as a leading force in the direct equity access space, connecting individuals with a broad range Mini-IPO First JOBS Act of investment choices. Through his work, Altahawi has not only democratized equity access but also encouraged a cohort of investors to seize the reins of their financial futures.

Taking the Direct Route for Andy Altahawi's Company

Andy Altahawi's company is considering a direct listing as a route to going public. While this approach provides some perks, there are also risks to keep in mind. A direct listing can be cost-effective than a traditional IPO, as it avoids the need for underwriting fees and a roadshow. It can also allow firms to go public more quickly, giving them access to capital sooner. However, direct listings can be difficult to execute than traditional IPOs, requiring solid investor relations and market knowledge. Additionally, a direct listing may result in smaller initial media coverage and market attention, potentially hampering the company's development.

- In Conclusion, the decision of whether or not to pursue a direct listing depends on a number of factors specific to Andy Altahawi's company, including its phase of growth, funding needs, and market conditions.

A Direct Listing Strategy for Andy Altahawi's Growth?

Andy Altahawi, an entrepreneur in the financial world, is constantly seeking innovative ways to propel his success. One intriguing option gaining traction is the direct listing. A direct listing allows companies to go public without involving an underwriter or the traditional IPO process. This can be particularly appealing for established companies like Altahawi's, as it avoids the complexities and costs tied with a traditional IPO. For Altahawi, a direct listing could offer several advantages: increased brand recognition, access to a wider pool of investors, and ultimately, driving growth.

- A direct listing can provide Altahawi's company with significant funding to expand its operations, develop new products or services, and leverage on emerging market opportunities.

- By going public directly, Altahawi could demonstrate confidence in his company's future prospects and attract skilled individuals to join his team.

Nevertheless, a direct listing also presents risks. The process can be complex and intensive, requiring careful planning and execution. Additionally, a direct listing may not be suitable for all companies, particularly those that are still in their early stages of growth.

Ben Savage Then & Now!

Ben Savage Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Hailie Jade Scott Mathers Then & Now!

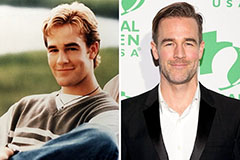

Hailie Jade Scott Mathers Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now!